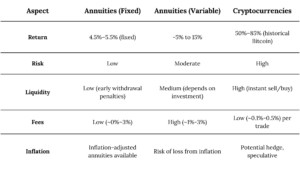

Guaranteed but low returns vs risky but possible high returns. That’s essentially the choice you are making when comparing annuity and crypto. But for us to get an objective view of these investment vehicles, we need to focus on several key aspects: returns, risk, liquidity, and other characteristics. I'll break down these comparisons and provide you with concrete numbers where available, along with some references.

RETURNS

Annuities: Annuities are generally seen as low-risk, stable investments. Their returns depend on the type (fixed, variable, or indexed). Here’s a breakdown:

Fixed annuities: Offer a guaranteed return. In 2024, average interest rates for fixed annuities are around 4.5%–5.5% annually, though this can vary based on the term length and market conditions.

Variable annuities: Linked to the performance of underlying investments (typically mutual funds). These can range from -5% to 15% annually, depending on the market.

Indexed annuities: Tied to stock indices like the S&P 500. They offer downside protection but may have cap limits on gains. Returns can range from 0% to 10%, depending on index performance and caps.

Cryptocurrency: Cryptocurrencies are highly volatile, with potential for high gains or significant losses. Here are some numbers for specific assets:

Bitcoin (BTC): Over the past 5 years (2019–2024), Bitcoin’s annualized return has been 85%, but with massive volatility. Year to date, Bitcoin has gone up 41.69% and is north of $62,000.

Ethereum (ETH): Ethereum’s annualized return over the same period was around 75%. This year, Ethereum is up 7.01% and is north of $2400.

RISK

Annuities

Low risk for fixed and indexed annuities. They are generally backed by insurance companies and regulated. You’ll get at least your principal back (in the case of fixed annuities).

Variable annuities are riskier because their value fluctuates based on the market, and you can lose principal.

A fixed annuity with a 5-year term at 5% interest would turn $100,000 into $127,628 after 5 years.

Cryptocurrency

Investing $100,000 in Bitcoin at the start of 2023 ($16,500) and selling at its peak in mid-2023 ($30,000) would have resulted in $181,818 in just a few months (an 81% return). However, holding it through major corrections could reduce that amount significantly.

Alternatively, investing in Terra (LUNA) in early 2022 would have resulted in a 100% loss as the cryptocurrency collapsed.

Liquidity

Annuities can tie you down. Most annuities come with surrender charges if you withdraw early, especially in the first 5–10 years. You might face a 7% penalty for early withdrawal from an annuity within the first year, with a declining penalty over time.

Cryptos can be traded 24/7, and you can convert them into cash instantly, though you may face slippage or market spread costs during extreme volatility. Selling $100,000 worth of Bitcoin at a 2% price dip during high volatility would mean receiving around $98,000, minus transaction fees.

FEES

Fixed annuities often have low fees or none. Variable annuities tend to have high fees (1-3% annually), including management fees and mortality expenses.

Cryptocurrency fees depend on the platform. Most exchanges charge 0.1%–0.5% per trade. For example, buying and selling $100,000 worth of Bitcoin might cost $500 in total fees.

INFLATION PROTECTION

Fixed annuities can lose purchasing power due to inflation, while inflation-adjusted annuities offer lower returns but are protected from inflation.

A $100,000 fixed annuity at 5% may yield $5,000 annually, but if inflation runs at 3%, the real value of that return drops to around $1,940 in purchasing power over 20 years.

Cryptocurrency is often considered an inflation hedge, but this is highly speculative. Bitcoin is designed to be deflationary, with a limited supply. Bitcoin rose over 300% during the 2020–2021 inflation period, but this was also due to a general crypto bull market.

SUMMARY

A well-balanced retirement portfolio should combine the stability of traditional investments with the potential growth of emerging assets, such as annuities and cryptocurrencies. While these two investment types may seem worlds apart, both play essential roles in ensuring a diversified strategy that maximizes security and growth potential.

Annuities provide a reliable source of income, especially as individuals seek predictability in their later years. With options such as fixed, variable, or indexed annuities, investors can tailor their risk level and return potential. Fixed annuities offer guaranteed returns, often around 4.5% to 5.5% annually in today’s market, providing the security of knowing that your income is protected regardless of market fluctuations. For those willing to take on more risk, variable annuities allow exposure to equity markets, potentially offering higher returns (5% to 15%) over time.

For retirees, this dependable income stream from annuities helps cover essential living expenses, such as housing, healthcare, and daily needs, providing a foundation of financial stability. Moreover, some annuities offer inflation protection or lifetime income guarantees, ensuring your purchasing power doesn’t erode over time.

On the other side of the spectrum, cryptocurrencies like Bitcoin and Ethereum offer a unique opportunity for growth. While cryptos are highly volatile, their historical performance demonstrates significant returns, with Bitcoin averaging annualized returns of around 85% over the past 5 years. Although no one can predict future gains with certainty, the inclusion of a small portion of cryptocurrency in a retirement portfolio could serve as a growth driver, especially during inflationary periods when traditional assets may underperform.

Cryptocurrency also offers diversification. Traditional markets like stocks and bonds often move in correlation with each other, while crypto remains more independent of these trends, potentially acting as a hedge in times of market turmoil. For retirees, this means exposure to an asset that, although speculative, could offset underperformance in other parts of their portfolio, ensuring more robust long-term growth.